Rober Iturriet Ávila[2]

Cristina Pereira Vieceli[3]

Only in the end of 2014, the Brazilian Federal Revenue Office started to provide more raw data from personal income tax declarations. The information available before the year 2014 was restricted to the total number of declarants. As this information becomes known, further analysis is possible.

The information presented in this text takes into account the income declarations made by taxpayers to the Brazilian Federal Revenue Office concerning 2017. It is known that an individual who received more than R $ 2,379.98 monthly in 2017 declared income tax, as well as that those with assets is above R$ 300,000.00. In that same year, 29.1 million people declared income tax in Brazil. This contingent represented 13.90% of the total Brazilian population and 20.20% of the population over 19 years old.

The income of the declarants receives three different tax treatments. The “taxable income” represented 59.07%, the “exempt income” reached 30.88%, and 10.06% were “taxed exclusively at source”. The sum of these three types of income we will call “total income”.

Taxable income is mainly composed of income from work, although it also includes property income, such as rents. Income taxed exclusively at source includes income from financial investments and 13th salary. Much of the exempt income is profits and dividends, but there are also FGTS withdrawals and scholarships. In the following analyzes, couple declarations by married individuals were excluded, therefore, just individual declarations are considered.

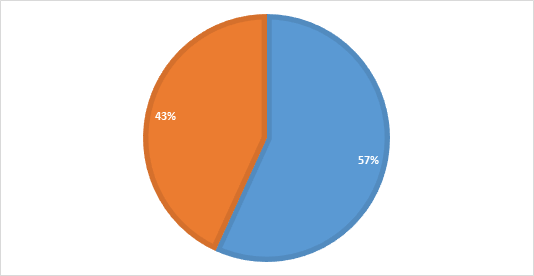

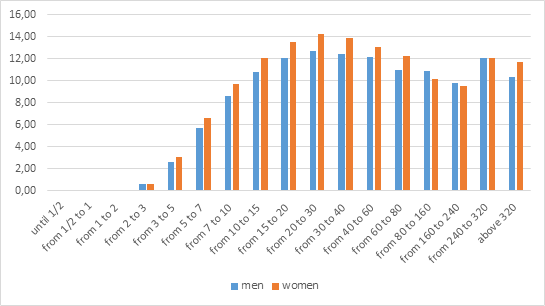

Data on income statements by sex indicates inequalities between men and women, regarding the proportion of declarants and regarding income and ownership of goods and services. As an example, in 2017, 56.8% of individual declarants were men and 43.2% were women, according to Graph 1.

Graph 1

Proportion of income tax declarants by sex, Brazil, 2017

Source: Receita Federal do Brasil (Brasil, 2017). Author’s elaboration.

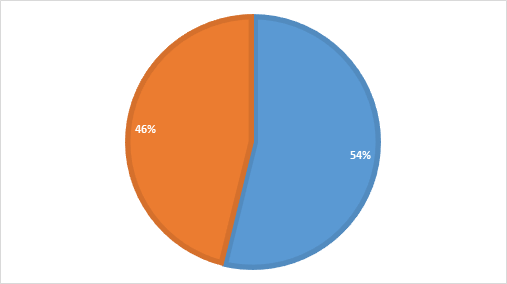

Regarding the mass of total income, men remained with 53.8% and women 46.2% (Graph 2).

Graph 2

Proportion of the average income of declarants by sex, Brazil, 2017

Source: Receita Federal do Brasil (Brasil, 2017). Author’s elaboration.

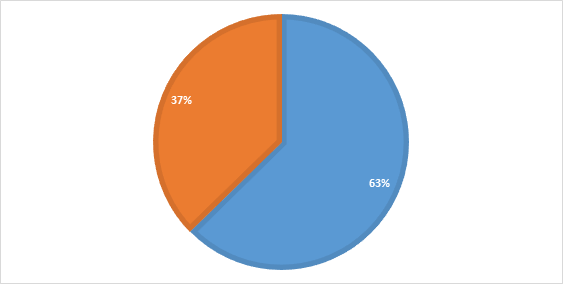

When the declared assets are analyzed, there is a greater disproportion: 63% belong to men and 37% to women (Graph 3).

Graph 3

Proportion of declared assets by sex, Brazil, 2017

Source: Receita Federal do Brasil (Brasil, 2017). Author’s elaboration.

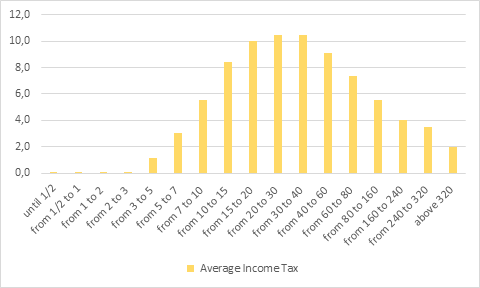

As in Brazil profits and dividends distributed to shareholders are exempt from income tax, starting from the range of 40 minimum monthly wages, there is an increasing exempt share. Consequently, the effective rate is reduced to the highest levels of income. Graph 4[4] explains this tax regressive present in the Brazilian Personal Income Tax (IRPF).

Graph 4

Average rate of Income Tax, by range of minimum wage and sex Brazil, 2017

Source: Receita Federal do Brasil (Brasil, 2017). Author’s elaboration.

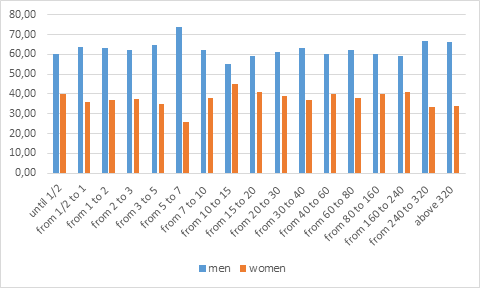

However, for data with distinction of sex, there is no available order by total earnings, only by taxable earnings, which mainly cover salaries. It is noteworthy, in Graph 5, that women pay a higher personal income tax rate in almost all ranges, in exception of the two ranges between 80 and 240 minimum wages, in which the rates of men are slightly above that of women. This contributory configuration signals that men have higher exempt earnings, that is, probably the individuals receiving profits are mostly men, the effective result is that women pay more income tax than men.

Graph 5

Effective tax rate by minimum wage range and sex, Brazil, 2017

Source: Receita Federal do Brasil (Brasil, 2017). Author’s elaboration.

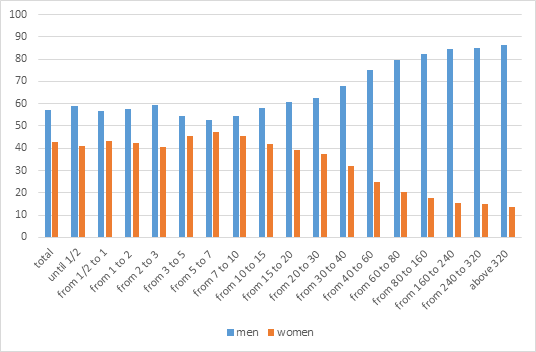

When observing the proportion of income taxpayers per minimum wage rage between men and women, the above hypothesis gets stronger. Men are the majority in all range, and make up 56.8% of declarants, however, from 30 minimum monthly wages, the participation of women will drop until reaching only 14% in the range above 320 minimum monthly wages. It is worth remembering that in this income rage, most of the declarants are receivers of profits and dividends, who pay less income tax. Thus, Graphs 5 and 6 illustrate two important points: the wide gender gap in the upper range and the finding that women pay more income tax than men.

Graph 6

Proportion of declarants by minimum wage range and sex, Brazil, 2017

Source: Receita Federal do Brasil (Brasil, 2017). Author’s elaboration.

The disparity in declared property is also accentuated. According to Graph 7, when taking into account the difference between assets, declared debt and encumbrances, there is a greater disproportion than individual income. It should be noted that the data do not allow knowing the net equity of each individual, but rather by ranges of individuals, segmented into minimum wage levels. Even in the lowest income ranges the disproportion is considerable, with an emphasis on 5 to 7 minimum wages: 74% of the assets belong to men, even though their participation among such taxpayers is 55%.

Graph 7

Proportion of individual average liquid property by minimum wage range, Brazil, 2017

Source: Receita Federal do Brasil (Brasil, 2017). Author’s elaboration.

In this measure, the main conclusions are that: i) there is a significant disproportion of declared assets between men and women, even higher than the income disparity; ii) in the highest income ranges, more than 80% of the declarants are men; iii) women pay higher rates income tax than men. Thus, the Brazilian tax configuration accentuates income inequalities between men and women in Brazil. When analyzing consumption taxation, this effect is even greater, a point to be presented in later studies.

References:

BRASIL. Ministério da Fazenda. Receita

Federal. Centro de estudos tributários e aduaneiros.2017.Available in:

<http://idg.receita.fazenda.gov.br/dados/receitadata/estudos-e-tributarios-e-aduaneiros/estudos-e-estatisticas>.

Access in: 13 nov. 2019.

[1] The article is a preview of a technical study on taxation and gender supported and coordinated by Instituto Justiça Fiscal (Tax Justice Institute)

[2] PhD in economics, professor and researcher at Universidade Federal do Rio Grande do Sul (UFRGS)

[3] PhD candidate in economics at Universidade Federal do Rio Grande do Sul and licensed technician at Departamento Intersindical de Estatística e Estudos Socioeconômicos (DIEESE).

[4] From this point in the text, couple declarations are considered, which make up 3.1% of all declarations.

The Portuguese version can be acessed clicking HERE.

You can download the PDF by clickin HERE.